Reinsurance & Africa Risk Consulting

Reinsurance & Africa Risk Consulting

Project risk is unique in that risk profiles are constantly changing as the project moves from an idea, through planning and design and contracting, then through logistics, construction, testing & commissioning, and finally into commercial operations.

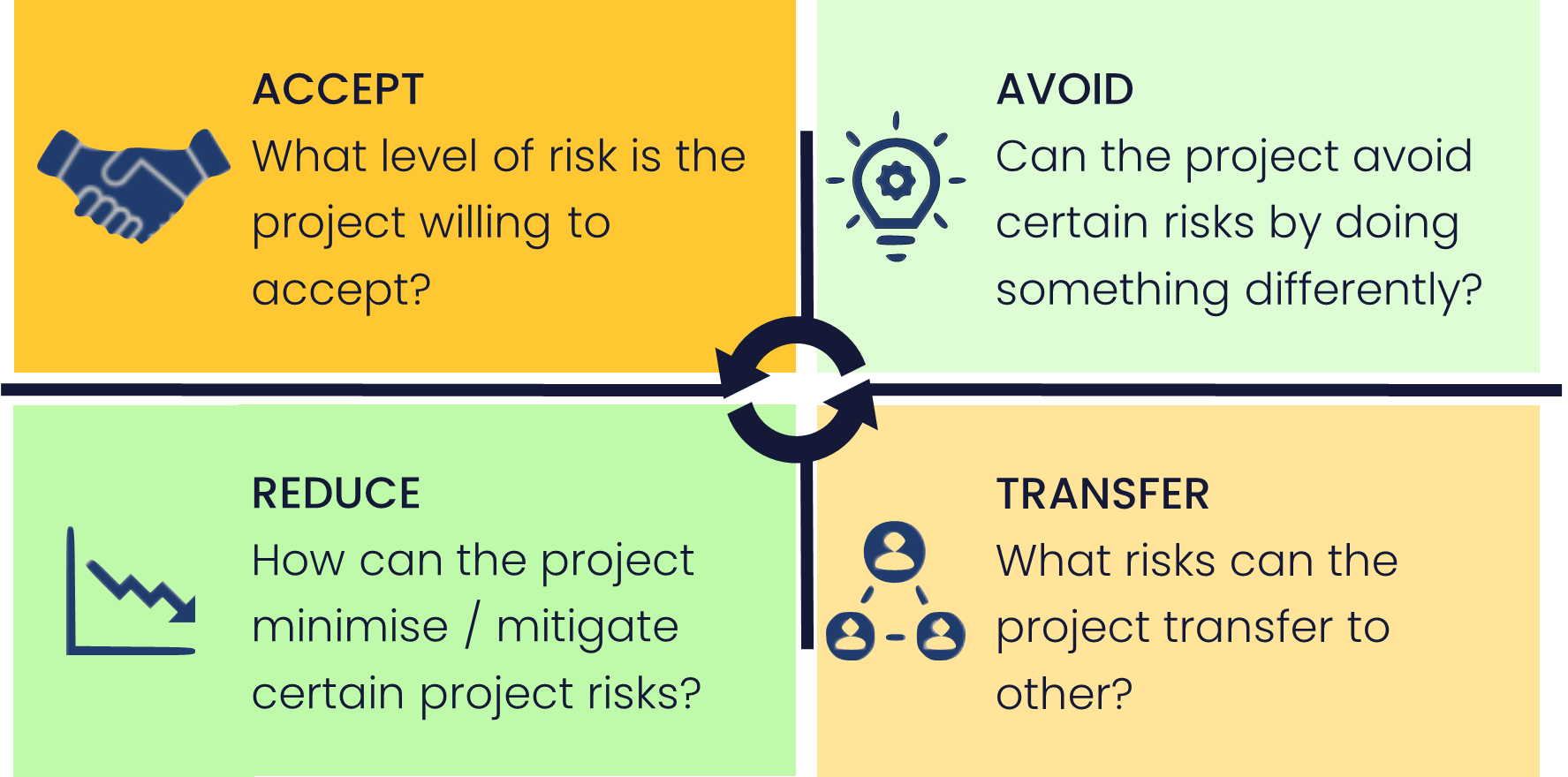

Having a clear understanding as to the differing risks and how these may be mitigated is crucial for the successful realisation of any project.

Price Forbes’ specialist team has extensive experience of the Oil, Gas, Petrochemical, Power Metals and Mining sectors and is used to working with all parts of the project (Technical, Legal & Financial) to assess both the project’s specific risk profile and to assist in finding ways to minimise these risks.

As an owner’s project insurance consultant, Price Forbes looks to understand the risks clearly before suggesting the best ways to utilise insurance to mitigate some of these risks.

Price Forbes is used to interacting with Project Management, Project Management Consultants, Contractors, Owner’s & Lenders’ Lawyers, Finance Teams / Lenders and the Insurance Industry so as to assist the Project in achieving an appropriately balanced risk profile which is acceptable to the Project Parties.

Contractual & Technical Risk Review

- Discuss proposed allocation of risk strategy between all of the parties (project owner, contractors and/or lenders and/or others as applicable) and the resulting risk allocation philosophy.

- Review and discuss with the Project the proposed risk and indemnity clauses that form part of the construction contracts.

- Technical risk review with the project team and/or their appointed contractors.

Collection, Development And Production Of Project Underwriting Information

- Provide the Project with the appropriate technical questionnaires.

- Explain to both the Project and contractors what is required of them so that complete answers to the questions in the questionnaires are provided in the shortest time.

- Support and/or assist as necessary either the project team or contractors or both in the collection of and the relevant information.

- Discuss with the Project the format and the contents of the final underwriting presentation.

- Ongoing risk analysis / examination of risks posed.

- Provide feedback to project as to any technical concerns or issues that come to light that could be of concern to underwriters, including any new technology/methodology or scale up issues.

Lenders Requirements

- Prepare a Owners Insurance Report for presentation to the Lenders – outlining the projects scope of work and intended insurance strategy to mitigate the perceived risks.

- Review the scope of insurance requirements under any project finance documents including any loan syndication documents.

- Attend meetings with lenders and/or lenders representatives as required.

- Provide feed-back to lenders and/or their representatives as to the availability /scope of lenders’ insurance clauses and assignments that the insurance and reinsurance markets will be willing to accept.

- Assist the Project in negotiations with lenders and their insurance advisors.

- Incorporate lenders’ requirements into the project insurance covers to the extent that they are achievable and/or to the extent that any market capacity or equivalent type clause in the project loan documents does not apply.

- Assisting lenders/their lawyers with the underwriter agreement of any insurance and reinsurance assignment

Other services:

- Policy Wording Drafting

- Broking Preparation

- Strategy For Approaching Insurers and / or Reinsurers

- Placement

- Administration

- Claims Servicing

- Continuing Project Support

- Transfer to Operational Insurances

- Operational Phase Insurances – (subject to a separate remuneration agreement)

Price Forbes South Africa is an independent insurance brokerage with offices across South Africa and capability across sub-Saharan Africa. We offer short-term and risk advisory solutions across a number of product specialties and with experience in multiple industries.

We are part of the Ardonagh Group and are able to enhance our local capability with this global capacity and strength to provide fair and honest advice, deliver exceptional service throughout and structure relevant solutions to meet our clients’ unique risk requirements.